Profit Formula: While people often use the terms benefit and revenue synonymously, they are quite different concepts in business. Revenue is the money generated through product and service sales. Profit is the amount that remains when you subtract the costs of doing business. In the short-term, creating revenue is a common financial objective. In the long-term, though, companies need profit to remain viable.

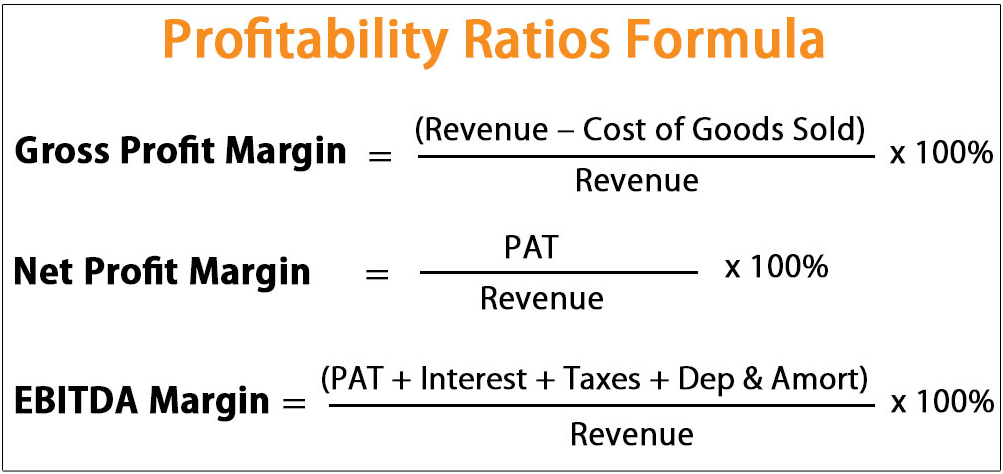

Gross Profit Margin Formula/Gross Profit Formula

The gross formula for percentage benefits the total revenue minus cost of things sold. It is the company’s profit before all interest and tax payments. Gross profit is also called gross margin. Find below the formula to calculate the gross benefit of a company.

The gross profit formula is given as:

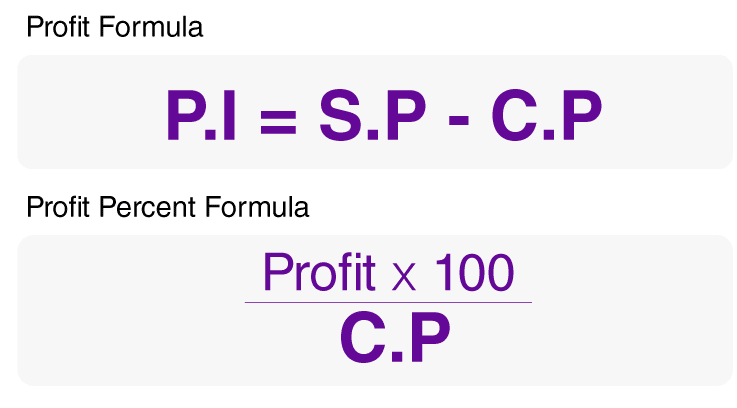

Profit Formula

The benefit Formulas are given as:

| Formula for benefit | Profit = S.P – C.P. |

|---|---|

| The formula for Profit Percentage | Profit Percent Formula = Profit×100C.P. |

| Gross Profit Formula | Gross Profit = Revenue – Cost of Goods Sold |

| benefit Margin Formula | Profit Margin = TotalIncomeNetSales |

| Gross benefit Margin Formula | Gross Profit Margin = GrossProfitNetSales |

Operating Profit Margin Formula | Net benefit Margin Formula

The benefit margin formula is used to calculate how much benefit a product or business is. It is probably the most important margin used by businesses to know the total profit percentage over a period of time. It is also known as net profit margin, net profit ratio or net margin in business terms.

Read Also: EBITDA formula

When net profit is divided by sales, the product we get is the profit margin. The formula for percentage profit and gross profit margin terms are usually used by small companies for comparing similar industries. It is denoted in percentage. The more the profit margin is, the more profitable the business will be.

Profit Margin Formula

To get the benefit margin, the total income is divided by total sales. Thus, the formula for benefit margin is:

| Profit Margin = (Total Income / Net Sales) |

Gross Profit Margin Formula

The gross benefit margin formula is derived by dividing the difference between revenue and cost of goods sold by the revenue.

| ∴ Gross Profit Margin = (Gross Profit / Net Sales) |

Net Profit Formula

- Cost price (C.P.): This is the price at which an article is purchased.

- Selling price (S.P.): This is the price at which an article is sold.

- Profit or Gain: If the selling price is more than the cost price, the difference between them is the profit incurred.

- Formula: benefit or Gain = S.P. – C.P.

- Loss: If the selling price is less than the cost price, the difference between them is the loss incurred.

- Formula: Loss = Cost price (C.P.) – Selling Price (S.P.)

- Profit or Loss is always calculated on the cost price.

- Marked price: This is the price marked as the selling price on an article, also known as the listed price.

- Discount or Rebate: This is the reduction in price offered on the market or listed price.

Below is the list of some basic formulas used in solving questions on profit and loss:

- Gain % = (Gain / CP) * 100

- Loss % = (Loss / CP) * 100

- SP = [(100 + Gain%) / 100] * CP

- SP = [(100 – Loss %) / 100]*CP

The above two formulas can be stated as,

If an article is sold at a gain of 10%, then SP = 110% of CP.

If an article is sold at a loss of 10%, then SP = 90% of CP.

- CP = [100 / (100 + Gain%)] * SP

- CP = [100 / (100 – Loss%)] * SP

Certainly! Here are some frequently asked questions (FAQs) regarding the Profit Formula:

1. What is the Profit Formula?

The Profit Formula is a mathematical equation used to calculate profit, typically represented as Profit = Revenue – Costs.

2. Why is the Profit Formula important?

It provides a clear understanding of a business’s financial health by showing the difference between the revenue generated and the costs incurred.

3. How can I use the Profit Formula to improve my business?

By analyzing revenue and costs, you can identify areas for growth and cost reduction, helping you strategize for increased profitability.

4. Is the Profit Formula applicable to all types of businesses?

Yes, the Profit Formula can be applied to various business models and industries to determine profitability.

5 What are the key components of the Profit Formula?

The primary components are Revenue (total income from sales) and costs (total expenses, including both fixed and variable costs).

6. Can the Profit Formula account for taxes and other deductions?

Taxes and other deductions can be considered as part of the costs, or they can be calculated separately, depending on the specific analysis.

7. How can I calculate profit margin using the Profit Formula?

Profit margin can be calculated by dividing the profit by revenue and multiplying by 100, showing the percentage of profit relative to revenue.

8. Is the Profit Formula different for service-based and product-based businesses?

While the core equation remains the same, the specific revenue streams and cost structures may vary between service and product-based businesses.

9. What tools can assist in applying the Profit Formula?

Financial software, spreadsheets, and professional financial analysts can assist in applying the Profit Formula accurately to your business’s unique situation.

10. Where can I learn more about the Profit Formula and its applications ?

Business financial books, online courses, and consultation with financial professionals can provide further insights into the Profit Formula.

These FAQs provide an overview of the Profit Formula and its importance in assessing and improving the financial performance of a business. Always consult with financial professionals for personalized guidance.