What Is FUTA Tax?

FUTA: You are welcome to the Federal University of Technology, Akure (FUTA), a top-ranking university of technology in Nigeria and indeed the nation’s pride. Established in 1981, the university has grown tremendously, stretching its academic disciplines and research across eight different schools and over fifty academic departments.

The Federal Unemployment Tax Act (FUTA) is a federal law that imposes an unemployment tax on employers. The FUTA tax funds the federal government’s oversight of each state’s unemployment program. Only employers pay FUTA tax. You must deposit the tax quarterly and file an annual form.

Have you ever heard of a strange-sounding tax called FUTA? All employers need to know about this funky acronym because they need to pay for it. So, what is the FUTA tax? Below you’ll learn about FUTA tax, the rates, and how to report and deposit the tax.

What is the FUTA tax rate for 2019?

What is the FUTA tax rate?

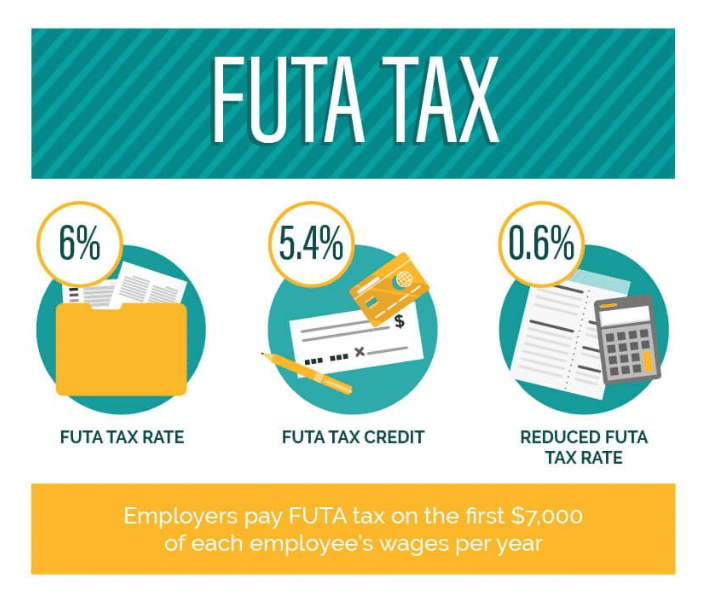

The Federal Unemployment Tax Act (FUTA) requires employers to pay a tax of 6% on the first $7,000 of salary or wages paid to each employee during the year. This tax is deposited with the IRS throughout the year. Employers file Form 940 to calculate their tax for the previous calendar year.

What is the FUTA tax rate for 2018?

Futa Tax Rate

Definition of Federal Unemployment Tax Act (FUTA)

The Federal Unemployment Tax Act (FUTA) is the original legislation that allows the government to tax businesses with employees for the purpose of collecting revenue that is then allocated to state unemployment agencies and paid to unemployed workers who are eligible to claim unemployment insurance. The Federal Unemployment Tax Act requires employers to file IRS Form 940 annually in conjunction with paying this tax.

The Federal Unemployment Tax Act (FUTA) is a federal provision that regulates the allocation of the costs of administering the unemployment insurance and job service programs in every state. As directed by the Act, employers are required to pay federal and/or state unemployment taxes which are used to fund the unemployment account of the government.

Read Also: profit formula

A business owes federal unemployment taxes if it paid at least $1,000 in wages during any calendar quarter in the current or previous year. (A calendar quarter is January through March, April through June, July through September, or October through December).

As of 2018, the tax rate was 6% of the first $7,000 paid to each employee annually.

This means that if a company had 10 employees, each of whom earned wages of at least $7,000 for the year, the company’s annual tax would be 0.06 x ($7,000 x 10) = $4,200. Once an employee’s year-to-date (YTD) wages exceed $7,000, an employer stops paying FUTA for that employee. Therefore, the maximum amount an employer pays in this tax is $420 per employee.

Many states collect an additional unemployment tax from employers. Employers can take a tax credit of up to 5.4% of taxable income if they pay state unemployment taxes. This amount is deducted from the amount of employee federal unemployment taxes owed. Thus, the minimum amount an employer can pay in tax is $42 per employee. However, companies that are exempt from the federal unemployment tax do not qualify for the FUTA credit.

Read Also: EBITDA formula

Wages an employer pays to his or her spouse, a child under the age of 21, or parents do not count as FUTA wages. Furthermore, payments such as fringe benefits, group term life insurance benefits, and employer contributions to employee retirement accounts are not included in the tax calculation for federal unemployment tax.

Futa Tax Rate 2019

FUTA and SUTA tax rates are calculated based on the number of an employee’s wages, up to a certain limit. The rates and wage limits can change periodically.

Jennifer Affrunti, a CPA and controller at Nussbaum Yates Berg Klein & Wolpow, PC, says “It is worth noting that the wage base and rates for FUTA have not increased… for quite a while. While there is nothing definitive right now, there are discussions in the works that would reinstate [higher taxes] sometime in the future.”

Futa Tax Rate 2016

The U.S. Department of Labor recently announced that employers in the state of California and in the Virgin Islands will pay their Federal Unemployment Tax Act, or FUTA, taxes for the calendar year 2016 at a higher tax rate than employers in other states.

This is because California and the Virgin Islands failed to repay their outstanding federal unemployment insurance (UI) loans as of November 10, 2016. Originally, there were three states facing increased FUTA rates going into the beginning of the year. But both Ohio and Connecticut managed to beat the deadline finally.

Unfortunately for employers in the remaining two locales, they will face another decrease in their allowable credit reductions. Currently, both California and the Virgin Islands are facing a 1.8% credit reduction for the 2016 tax year, which will result in an additional cost per employee of $126 for employers.

Futa Tax 2017

Unemployment insurance provides payments to employees who are laid off or lose their jobs through no fault of their own. The money for unemployment insurance payments comes from employer-paid federal and state unemployment taxes. Unlike Social Security and Medicare payroll taxes, which are divided evenly between employers and employees, employees do not pay unemployment taxes. Employers do not withhold these taxes from their employees’ paychecks.

Both the federal government and state governments collect unemployment taxes from employers. The federal government sends its portion to the states to supplement what the states collect.

Any business that falls into either of these criteria must pay FUTA taxes:

- You paid employees at least $1,500 in wages in a calendar quarter during the current or previous year

- You employed one or more workers for at least some part of the day during 20 or more different weeks in the current or previous year. Full-time, part-time, and seasonal W-2 employees count. Don’t count independent contractors.

In general, you do not have to pay FUTA or SUTA taxes on your own income, unless your business is structured as a corporation. If you have a family-run corporation or partnership, your child’s wages (if 21 or older) and spouse’s wages count for FUTA and SUTA purposes.

The tests for household and agricultural employees are slightly different from the test above. And SUTA requirements vary by state, so it’s best to contact your state’s unemployment tax agency to find out if you have to pay SUTA taxes. Certain types of businesses, such as nonprofits, religious institutions, and educational institutions, are exempt from paying FUTA and SUTA taxes.